Putting it all together.

This is the fun part!

The Onboarding Process & Constructing Your Portfolio Mix

Step 1: Onboarding

Tell us about yourself & your expectations. Participate in a comprehensive Know Your Client (KYC) discussion. Complete KYC document, Investment Management Agreement (IMA), and we'll open the appropriate investment accounts at the agreed upon Custodian.

Step 2: Constructing the Investment Mix

For many investors, the cornerstone of your portfolio will be one of the Asset Allocation Portfolios - highly diversified, global balanced ETF driven portfolios. Next, depending on the size of the overall investment portfolio, you can chose one or more of the "satellite" individual stock investment strategies. A uniquely personalized Investment Policy Statement (IPS) will be constructed: a detailed investment strategy statement - by account - of all of your holdings with SciVest.

Step 3: Set it and Forget it!

At this point, You can fund your account with cash, and/or we complete any transfer of assets from other institutions. Upon funding, Your investment strategy will be deployed as stated on your IPS. Your account(s) is now on auto-pilot for you; which means we will perform auto rebalancing at the Manager's schedule and/or discretion. Of course, we are here for you anytime should you have questions or concerns.

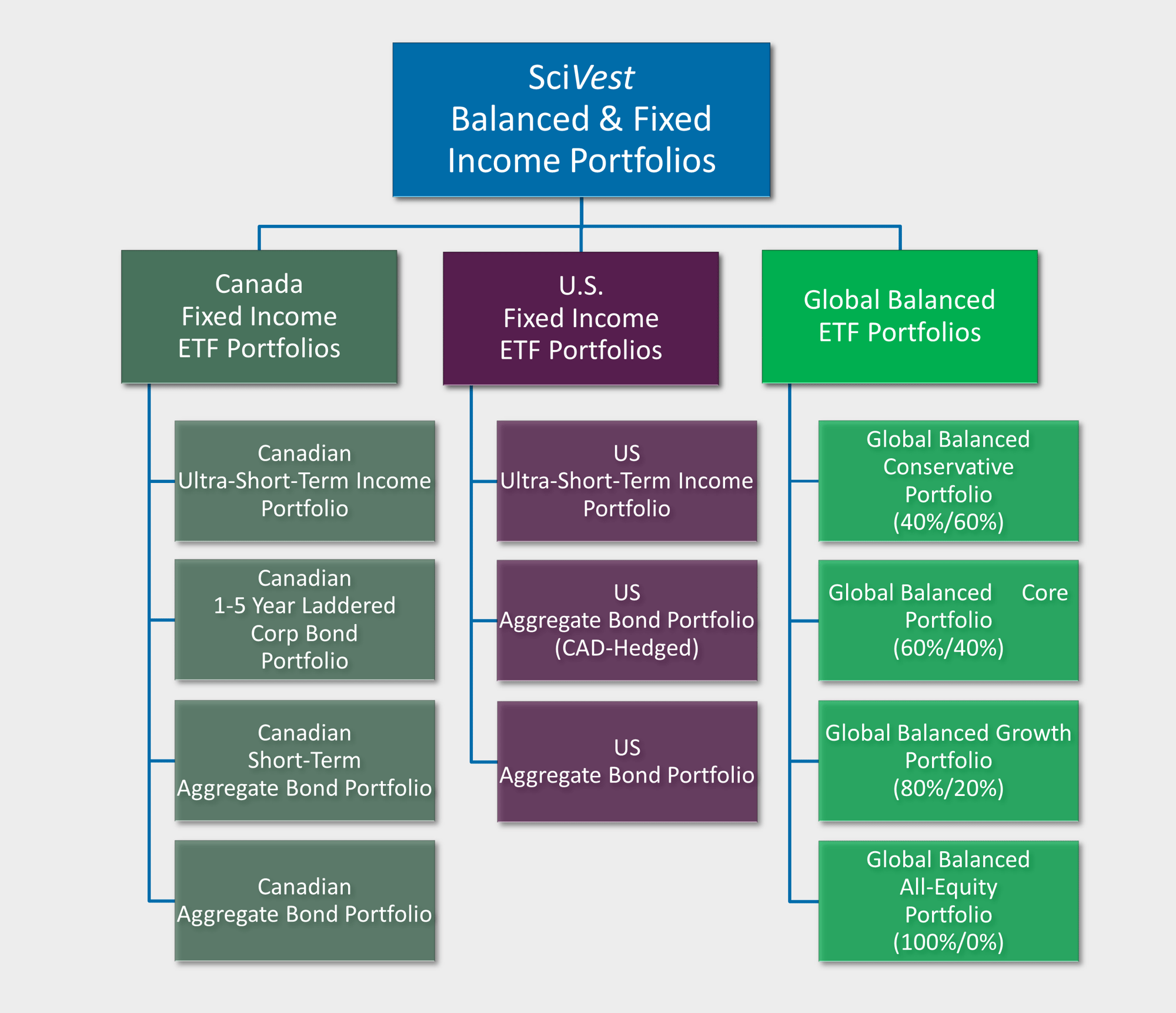

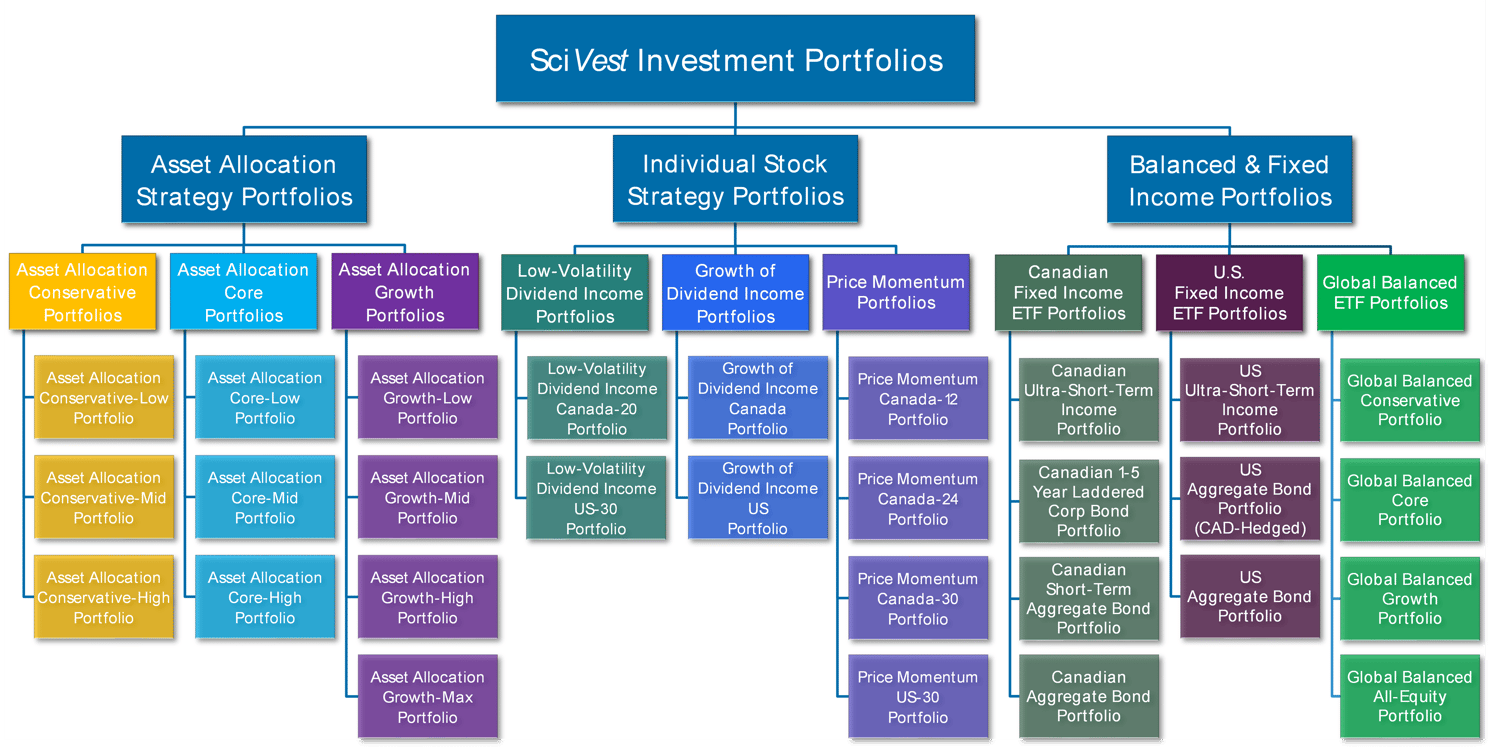

All Available SciVest Portfolios

How to Construct your Asset Mix

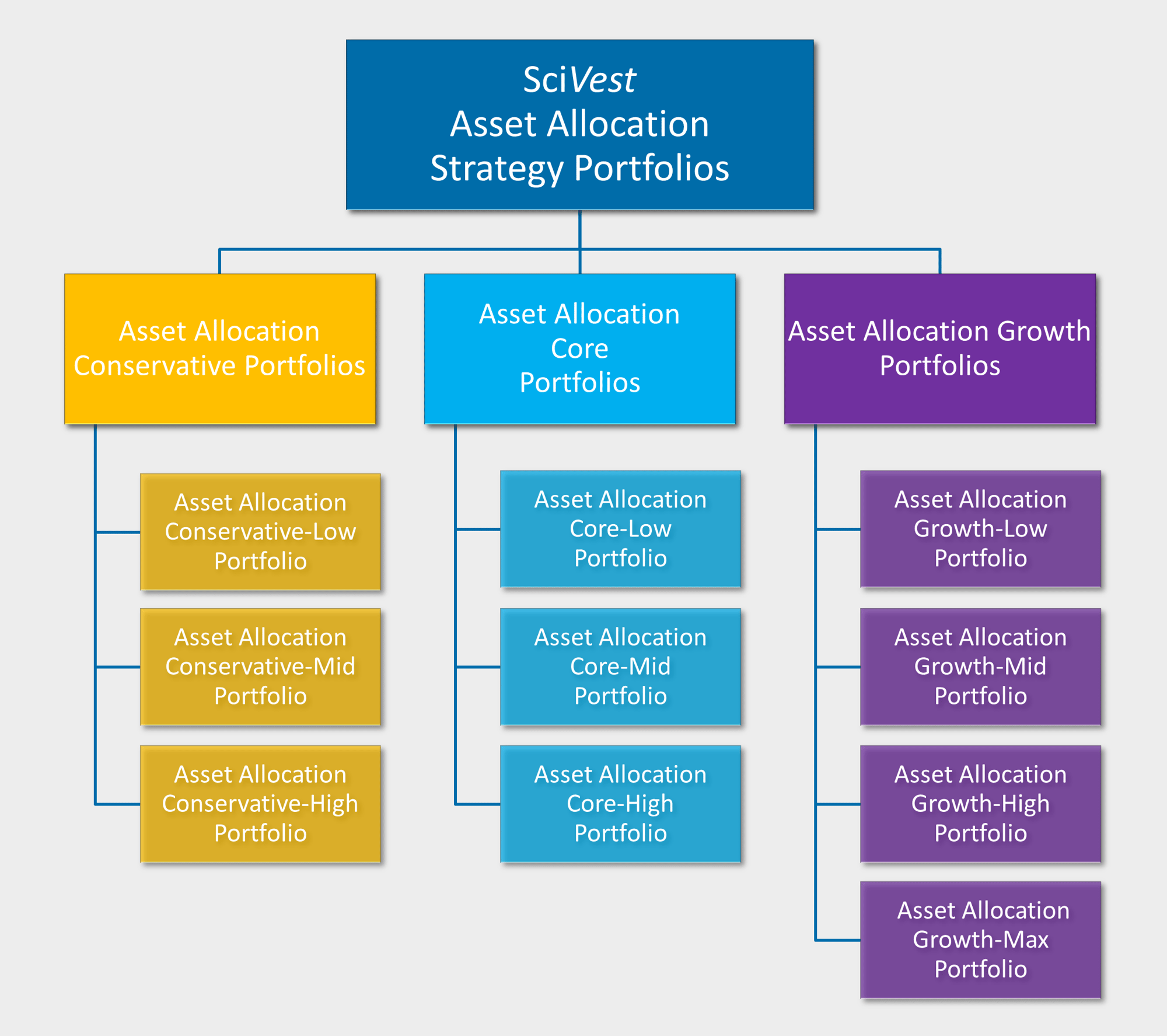

Asset Allocation Portfolios

Designed to form the core of any investor’s investment portfolio, each of these portfolios are;

-

Balanced: They include broad fixed income & equity asset classes, and often also include other alternative investments (i.e., non-bond and non-stock investments such as gold, convertible bonds, or REITs).

-

Global: They include sub-asset class investments from all over the world.

-

Highly Diversified: They hold numerous (14 to 22) sub-asset classes through carefully selected low-cost Exchange Traded Funds (or “ETFs”) which in aggregate, incorporate many thousands of underlying individual securities.

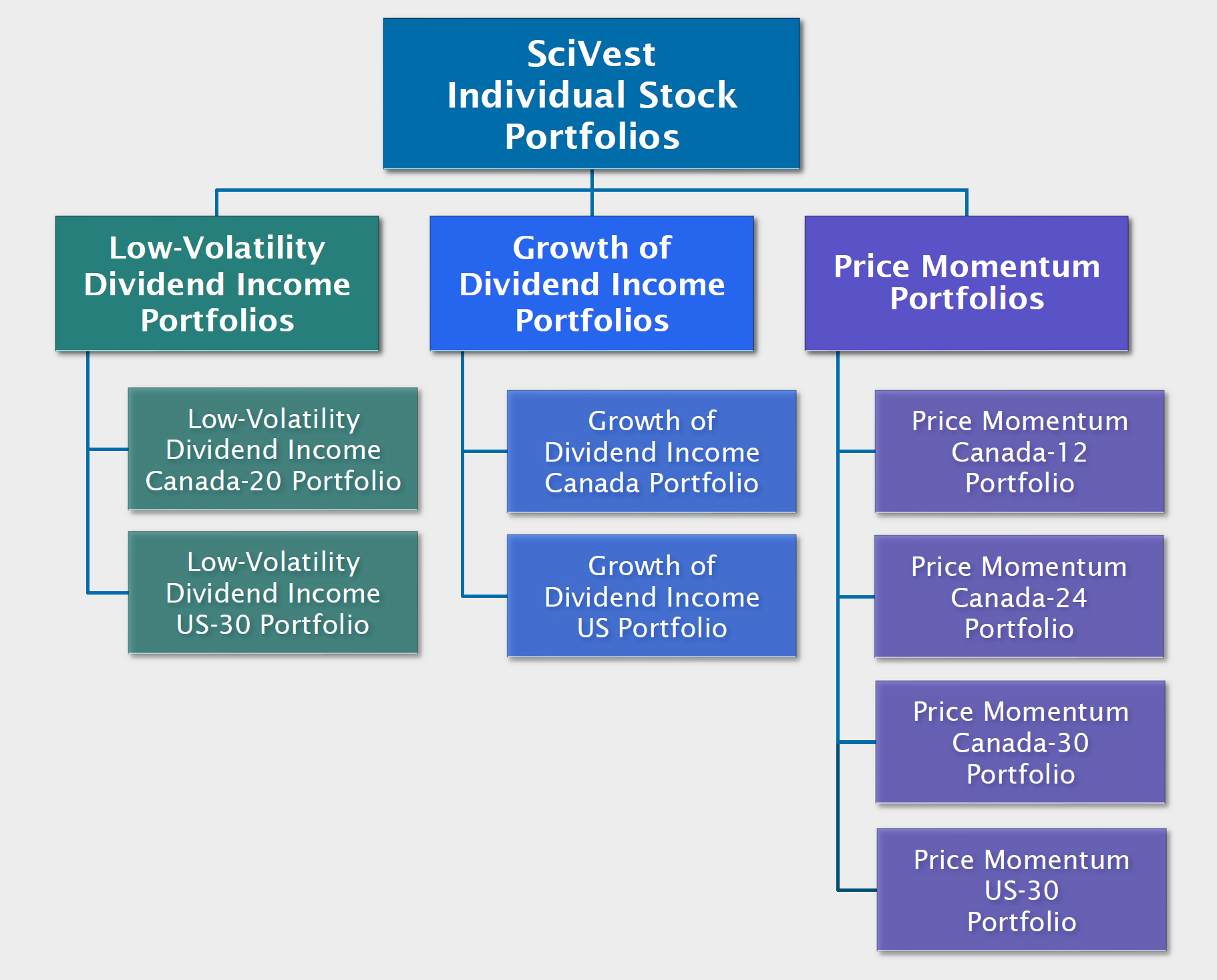

Individual Stock Portfolios

The addition of any of these "satellite" portfolios are terrific diversifiers and return/income enhancers to our SciVest Asset Allocation Portfolios, and therefore we encourage clients with large enough accounts to choose a combination of a SciVest Asset Allocation Portfolio and one or more SciVest Individual Stock Portfolio within each of the Accounts.

For a more detailed explanation of the individual strategies, please see the Investing tab, and review the Individual Stock Portfolios tab. Alternately, feel free to contact us directly for a more in-depth conversation on any of our strategies.

Balanced & Fixed Income Portfolios

These portfolios are thoughtfully constructed to provide investors regardless of their portfolio size with diversified exposure to both global markets and North American fixed income securities. They are ideal for those seeking a mix of growth and stability in their investment strategy.

-

Global Balanced ETF Portfolios:

Designed as two-ETF solutions that combine global equity and fixed income exposures to create a well-diversified investment strategy tailored to various risk profiles and financial objectives. Each portfolio includes one ETF focused on global equities and another on global fixed income, with asset allocations ranging from conservative (e.g., 40% equity / 60% fixed income) to aggressive (e.g., 80% equity / 20% fixed income). This structure provides investors with built-in diversification across asset classes and international markets, helping to reduce country-specific risk while supporting long-term growth potential.

-

Fixed Income ETF Portfolios:

Composed of single ETFs focused on Canadian and U.S. bonds or money market instruments, providing stable income and lower volatility. These portfolios are particularly well-suited for conservative investors or those looking to complement their equity holdings with more stable, income-generating assets.