Putting it all together.

This is the fun part!

The Onboarding Process & Constructing Your Portfolio Mix

Step 1: Onboarding

Tell us about yourself and your expectations. Participate in a comprehensive Know Your Client (KYC) discussion. Complete KYC document, Investment Management Agreement (IMA), and we'll open the appropriate investment accounts at the agreed upon Custodian.

Step 2: Constructing Your Investment Mix

For many investors, the cornerstone of your portfolio will be one of the Asset Allocation Portfolios - highly diversified, global balanced ETF-driven portfolios. Next, depending on the size of the overall investment portfolio, you can choose one or more of the "satellite" individual stock investment strategies. A uniquely personalized Investment Policy Statement (IPS) will be constructed: a detailed investment strategy statement - by account - of all of your holdings with SciVest.

Step 3: Set it and Forget it!

At this point, you can fund your account with cash and/or we complete any transfer of assets from other financial institutions. Upon funding, your investment strategy will be deployed as stated on your IPS. Your account(s) is now on auto-pilot for you; which means we will perform auto rebalancing at the Manager's schedule and/or discretion. Of course, we are here for you anytime should you have questions or concerns.

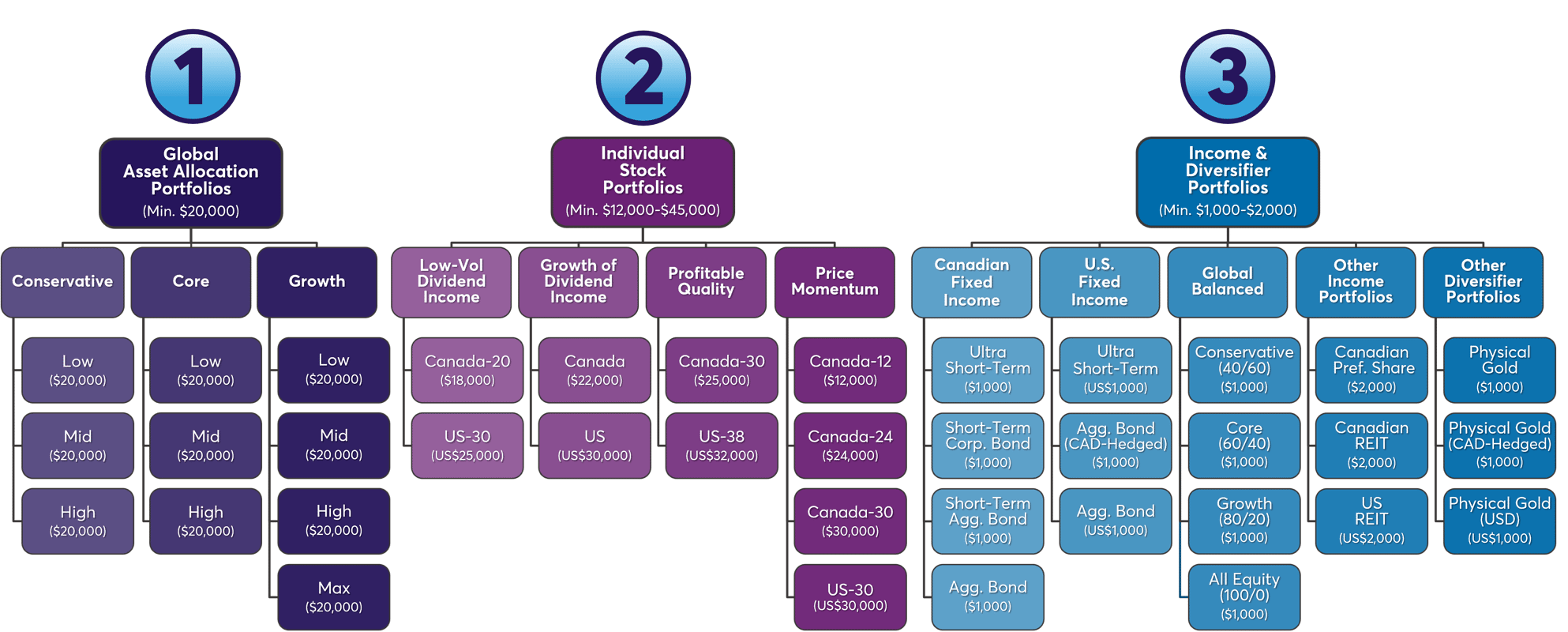

Constructing Your SMA Investment Mix

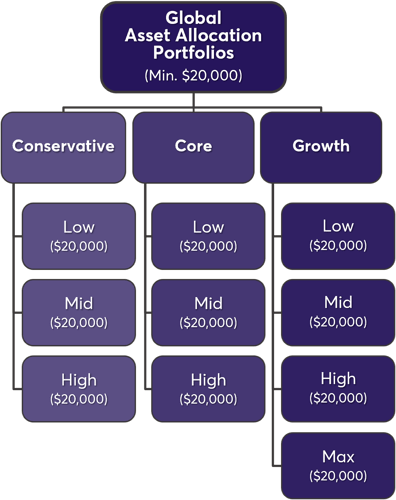

1. Asset Allocation Portfolios

The foundation of your Separately Managed Account is typically one of our highly diversified Global Asset Allocation Portfolios, giving you broad exposure to markets around the world.

Each portfolio is precisely engineered to deliver the highest long-term return appropriate for your risk level, using 16–21 carefully selected, low-cost ETFs.

Each Asset Allocation Portfolio provides exposure to stocks, bonds, and alternative investments across numerous countries and currencies — representing an incredible 10,000 to 30,000 underlying securities.

This globally diversified foundation provides a disciplined, evidence-based core upon which the rest of your SMA can be built.

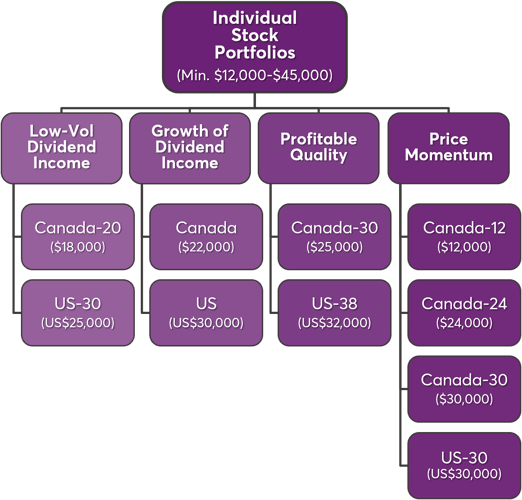

2. Individual Stock Portfolios

With your Separately Managed Account foundation in place, we can build the next layer of your SMA by adding one or more of our Individual Stock Portfolios.

We offer four proprietary, research-driven stock strategies, each holding individual equity securities in both Canada and the U.S.

Each strategy offers unique characteristics in growth, income, and risk, and is engineered to complement and diversify each other and the Global Asset Allocation Portfolios.

This “super-structure” layer provides targeted opportunities for dividend income, excess returns, tax efficiency, and enhanced diversification.

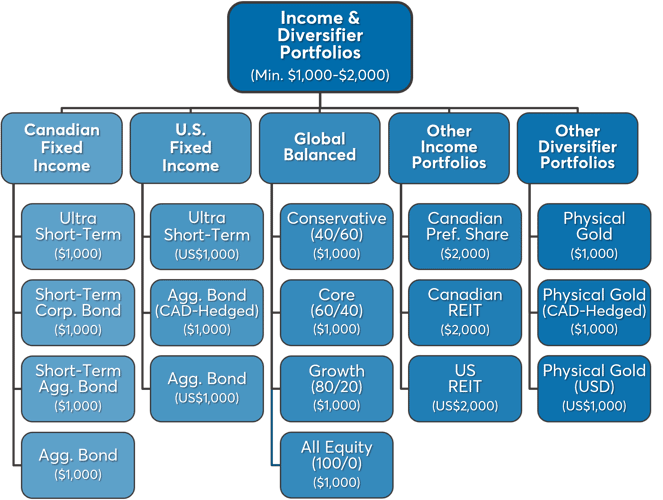

3. Income and Diversifier Portfolios

With the foundation and super-structure of your Separately Managed Account in place, our Income & Diversifier Portfolios provide the finishing layer — enhancing your SMA with specialized exposures designed to meet specific incremental objectives.

We offer five sleeves of low-minimum Income & Diversifier Portfolios, each consisting of one or more carefully selected, low-cost ETFs.

Each portfolio targets precise goals such as risk reduction, income enhancement, inflation protection, and incremental diversification — designed to fine-tune your SMA.

Your SciVest Separately Managed Account can be as unique as your goals

... and, don’t worry, we’re here to guide you every step of the way.