An Advanced Analytical Perspective Robert D. Arnott’s 2003 article, "Dividends and the Three...

What Drives Market Volatility?

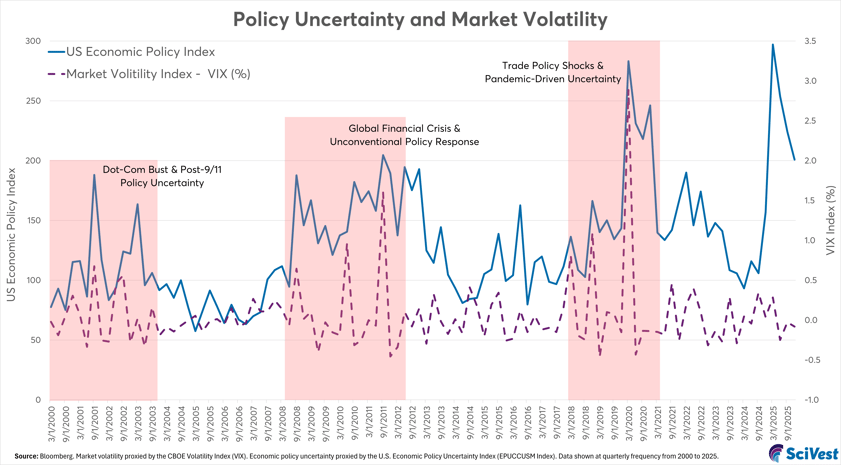

Market volatility refers to the degree of variation in asset prices over a given period. Volatility shows how much prices jump up and down over time. Experts often measure it using tools like standard deviation or, in the U.S., the CBOE Volatility Index (VIX) and it captures how rapidly and unpredictably markets move.

While volatility can signal risk, it also reflects the market’s process of incorporating new information from economic data to policy decisions and geopolitical events. Periods of turbulence are inevitable, but history shows that markets are cyclical.

Stormy days happen, but sunny days come back too.

The Key Drivers of Market Volatility

1. Economic Indicators and Data Releases

GDP Growth and Recession Signals

Quarterly GDP reports and advance estimates can trigger sharp market reactions, particularly when they deviate from expectations. For example, a slowdown in Canadian GDP growth below 0.5% may raise recession concerns, prompting equity markets to re-price valuations increased demand for defensive assets.

Inflation Readings

Consumer Price Index (CPI) releases, are among the most closely watched indicators. Surprises, whether above or below expectations, often drive bond yields and spark equity sector rotations. A sudden uptick in Canadian CPI from 2% to 3.5% year-over-year can spike uncertainty around interest-rate policy, increasing market volatility.

Employment Statistics

Labour market data further amplifies volatility by influencing expectations for central-bank action. Monthly jobs reports from Statistics Canada or the U.S. Bureau of Labor Statistics affect views on economic momentum, wage pressures which can influence central-bank policy outlooks and risk sentiment.

Ultimately, markets are less reactive to the data itself than to how it alters expectations for interest rates and policy decisions.

2. Monetary Policy and Central Bank Actions

Central banks play a pivotal role in shaping volatility:

Interest-Rate Decisions

Bank of Canada rate changes, or signals of future hikes, can cause sharp movements across asset classes. For example, a 25-basis-point increase by the Bank of Canada often leads to higher bond yields, a repricing of mortgage rates and adjustments to equity valuations.

Quantitative Easing/Tightening

Beyond interest rates, central banks also influence volatility through balance-sheet policies. During the COVID-19 pandemic, the U.S. Federal Reserve’s purchased roughly US$3 trillion (approximately CA$3.9 trillion) in assets, injecting liquidity into financial markets and helping suppress volatility. Conversely, rapid tapering or gradual shrinking of a central bank’s holdings of bonds can can withdraw liquidity and reignite market swings.

Statements from central banks about future rate plans

Forward-looking statements on rate paths or balance-sheet strategies add clarity but but when guidance deviates from market expectations, it can amplify volatility as investors rapidly adjust positioning.

3. Geopolitical Events and Global Risks

Trade Tensions

Tariff announcements between major economies introduce uncertainty for exporters and disrupt global supply chains. As uncertainty rises, markets often respond with heightened volatility, particularly in trade-sensitive sectors such as manufacturing, technology, and commodities.

Elections and Political Transitions

Federal elections in Canada or the U.K. and U.S. mid-terms can trigger short-term volatility as investors reassess policy priorities and prompt risk-off rotation in the days surrounding results.

Conflict and Sanctions

Geopolitical flare-ups, such as regional conflicts or new economic sanctions, can drive sudden spikes in commodity prices and equity volatility.

4. Corporate Earnings and Market Sentiment

Earnings Surprises

When major Canadian or U.S. corporations report profits well above or below forecasts, market reactions can be swift and pronounced. For instance, a surprise profit warning from a large bank can trigger a rally in insurance stocks as investors seek relative safety.

Forward Guidance and Revisions

Beyond reported results, changes to forward guidance often have an even greater impact on volatility. When companies revise earnings outlooks, particularly if multiple firms within the same sector do so simultaneously, it can ripple across broader indices as investors reprice future cash flows.

Investor Psychology

Herd behaviour, combined with fear and greed, can magnify price swings well beyond what fundamentals alone would justify. During periods of heightened uncertainty, valuations may overshoot in either direction before fundamentals eventually reassert themselves, reinforcing the cyclical nature of volatility.

5. Liquidity and Market Structure

Market Depth

Thin trading volumes, common during holiday periods, can amplify price movements, allowing relatively small trades to move markets disproportionately.

Algorithmic and High-Frequency Trading

Automated strategies may exacerbate short-term volatility, as seen in “flash crashes.” Regulators and exchanges continue to refine circuit breakers to mitigate these risks.

6. Natural Disasters and Black Swan Events

Extreme Weather & Health Crises

Severe storms or wildfires impacting energy infrastructure can cause abrupt commodity price moves. Further, Unexpected global health events, such as the onset of COVID-19 in 2020, can trigger sharp spikes in volatility as markets rapidly reprice economic and earnings uncertainty.

Why It Matters for Your Portfolio

Balancing Short-Term Swings with Long-Term Goals

Volatility can tempt investors to time the market, but evidence shows that disciplined, long-term strategies often deliver superior outcomes. Maintaining a clear investment plan and sticking to evidence-based principles helps investors navigate short-term noise without derailing long-term objectives and destroying wealth.

Diversification as a Risk Buffer

Diversification remains one of the most effective tools for managing volatility. Spreading investments across asset classes (equities, fixed income, and alternatives), regions (Canada, developed markets, and emerging economies), and sectors can help smooth portfolio returns when volatility is driven by a single factor.

Active Management and Tactical Adjustments

While long-term portfolio construction should be anchored in diversification, selective and measured adjustments can help manage risk during unusual market conditions. For example, reducing exposure to highly volatile sectors temporarily, while keeping your core portfolio steady, can help manage short-term swings.

Staying Disciplined and Avoiding Emotional Reactions

Emotional responses often amplify the negative effects of volatility. Panic selling can lock in losses, whereas systematic rebalancing and adding high-quality, fundamentally strong positions during market pullbacks can support long-term growth. Risk management emphasizes thoughtful portfolio adjustments over impulsive trading decisions.

.png?width=629&height=467&name=4%20Strategies%20(1).png)

Conclusion

Market volatility is not a flaw in financial markets, but a natural byproduct of how new information is absorbed and priced. While short-term fluctuations can be unsettling, investors who understand the underlying drivers of volatility are better positioned to respond rather than react emotionally.