If you've ever felt a rush of excitement during a market rally, or a wave of panic during a...

Total Cost Reporting (CRM3): What It Means for Investors

Imagine buying a car without knowing the full price until years after you've been driving it, only to discover you've been paying far more than you thought. Sounds absurd, right? Yet for many Canadian investors, this has been reality for investment management.

Since 2016, Canada's investment industry has operated under CRM2 a.k.a. Client Relationship Model – Phase 2, which brought significant improvements to fee disclosure. For the first time, investors received annual reports detailing what they paid their dealer or advisor, including trailing commissions, administrative fees, and trading charges, along with clear performance summaries. It was a big step forward, but still not the full picture.

Starting January 1, 2026, Canada will roll out Total Cost Reporting (TCR), also known in the industry as CRM3. For the rest of the article, we'll call it TCR.

This change puts Canada in line with transparency standards already common in the United Kingdom, European Union, and Australia. While the industry scrambles to adapt, firms built on transparency have been providing this level of clarity from day one.

For our clients TCR won't bring surprises. For many other Canadian investors, it might.

What CRM2 Covered (and what it didn't)

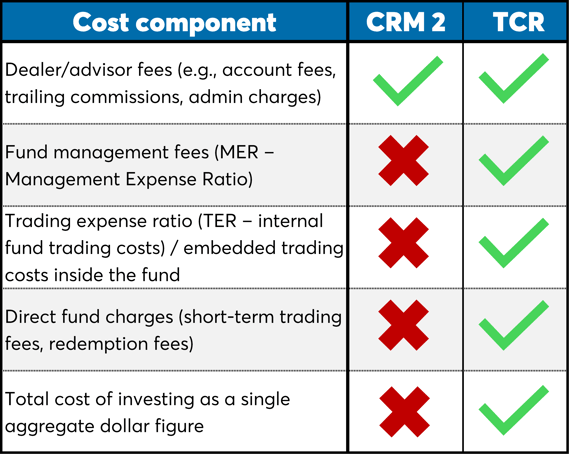

CRM2 was a meaningful step forward. It required three key disclosure of:

- Advisor and dealer compensation such as trailing commissions, admin fees, and trading charges

- Annual performance reports showing how your investments performed

- Cost reports detailing the fees you paid to your advisor and dealer

But CRM2 still had a significant blind spot. It did not require the inclusion of embedded fund-costs, specifically, the fees charged inside investment products, such as mutual funds or ETFs, via the Management Expense Ratio (MER) and Trading Expense Ratio (TER). While these costs existed and were disclosed (for example in prospectuses or fund facts documents), they were not part of the advisor/dealer annual report that most investors received, and therefore remained largely invisible.

The result? Investors could see only part of what they were paying. The largest expense many pay (fund management fees) largely remained out of sight and out of mind.

What Gets Disclosed Under TCR

- Advisor and dealer fees

- Fund-management expenses (e.g., management expense ratio, or MER)

- Trading expense ratio (TER) and other internal fund trading costs

- Performance fees and carried interest (if applicable)

- Embedded product costs previously hidden in fine print or prospectuses

- Aggregate dollar amount of direct fund charges (such as short-term trading or redemption fees)

- A fund-by-fund “Fund Expense Ratio” (%) and the actual dollar for each class/series the client owns or owned during the fee reporting year

- A “total cost of investing” figure (in dollars) reflecting all the above (dealer/adviser costs + fund/product costs)

In short, for the first time many investors will see a clear dollar amount of what the investment really cost them - not just what their advisor charged.

Why This Matters (and why it’s happening now)

Transparency isn't just a regulatory box to tick. It fundamentally changes the investor-advisor relationship.

- Full transparency empowers better decisions.

When you know exactly what you're paying, you can make informed comparisons between investment products, advisors, and firms. You can assess whether the value you're receiving justifies the cost. - It encourages accountability.

Advisors and firms that charge higher fees will need to clearly articulate and justify the fees they charge for the value they provide. The days of hiding behind complexity are ending. - It aligns Canada with global standards.

Other developed markets have required this level of disclosure for years. Canada is finally catching up, strengthening investor protection and rebuilding trust in an industry historically criticized for opacity

Lower fees & expenses mean more of your money stays invested and working for you, which directly improves long-term returns through the power of compounding.

For years, regulators recognized that investors were making decisions without knowing their true costs. The Canadian Securities Administrators (CSA) and the Canadian Council of Insurance Regulators (CCIR) agreed: partial disclosure wasn’t enough. Investors deserve to see the full picture.

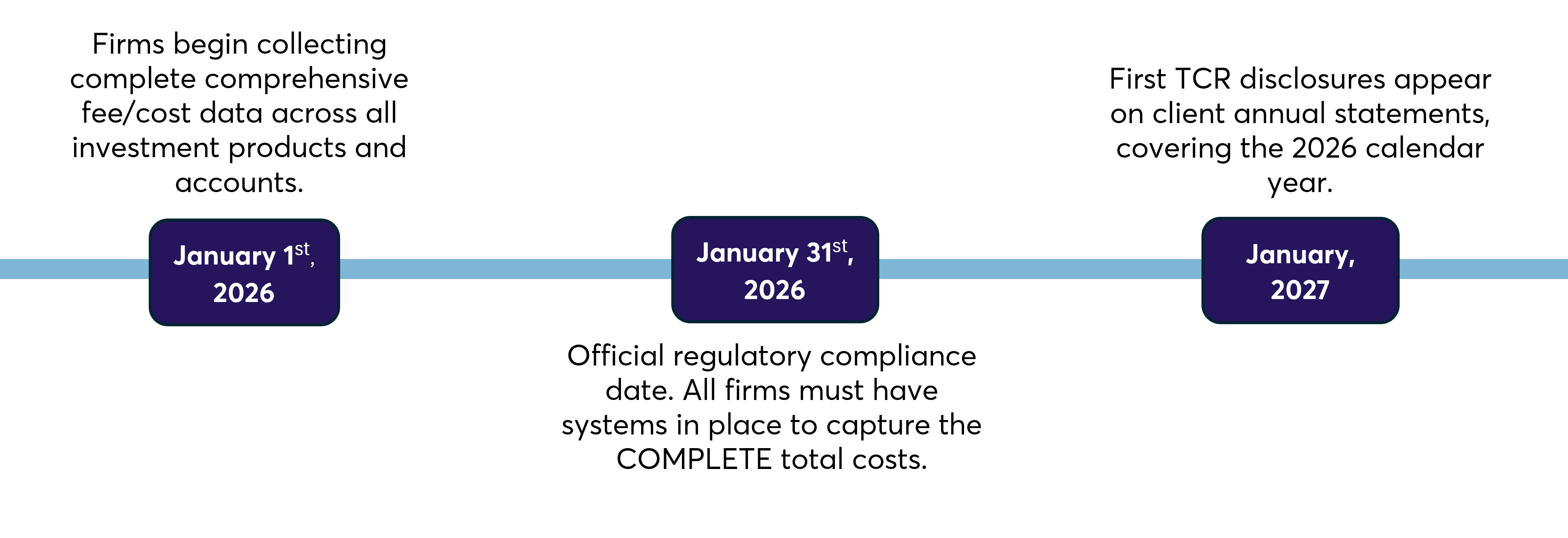

Implementation Timeline

Here's what the rollout looks like:

The 18-month window between now and the first disclosures gives firms time to build systems, train staff, educate clients, and manage expectations. Many firms are nowhere near ready, a reflection of how complex this change really is.

The Changes for Canadian Investors

What Your 2027 Statement Will Look Like

- A single, consolidated dollar figure showing your total annual costs, including both what you paid directly and what you paid indirectly through your fund

- Line-by-line breakdown of every fee component (advisor fees, fund management fees, internal trading/portfolio costs, redemption fees etc.)

- For each fund series you own, the percentage cost (e.g., a Fund Expense Ratio, or FER = MER + TER) and the actual dollar amount you paid in that year

- Where available, a year-over-year comparison so you can track how your cost of investing changes over time

An Eye-Opening Example

Let's say you hold $100,000 in a "low-fee" bank mutual fund with a 2.5% MER. Under CRM2, that MER was disclosed somewhere in the fund prospectus, but you never saw it as a dollar amount on your statement.

Under TCR, you'll see $2,500 in black and white, the actual cost deducted from your portfolio that year. Not buried somewhere on the prospectus. Right there on your statement.

For many investors, this will be the first time they truly understand what they've been paying. The psychological impact could be significant.

Why Traditional Firms Are Worried

The shift to total cost reporting presents serious challenges for many firms:

- The Opacity Advantage Evaporates.

For decades, some firms benefited from complexity. High fees were easier to justify when investors couldn't easily see them. With full transparency, that advantage disappears overnight. - Technical Challenges.

Building systems to capture, calculate, and report embedded costs across thousands of products is expensive and complex. Firms must integrate data from multiple sources, ensure accuracy, and present it clearly to clients. It's a massive operational undertaking. - The High-Cost Mutual Fund Problem.

Canadian bank mutual funds are among the most expensive in the developed world. According to Morningstar Canada, many actively managed funds charge MERs exceeding 2%, with some approaching 3%. These funds can no longer hide behind brand trust and advisor relationships. When clients see the dollar amount, difficult conversations will follow. - Reputational Risk.

Client conversations will shift from "Am I getting value?" to "Why am I paying this much?" Firms that can't provide compelling answers may face significant client attrition.

What This Means for You

- Expect revelation. Your 2027 statement may contain uncomfortable surprises. If you've never calculated the dollar impact of your fund's MER, you might be shocked.

- Use it as a catalyst. TCR creates a perfect opportunity to reassess whether you're getting value for what you pay. Are your returns justifying the costs? Is your advisor providing enough value to warrant their fees?

- Ask hard questions now. Don't wait for the January 2027 report. Ask your current advisor for a comprehensive cost breakdown today. If they can't or won't provide it, that tells you something important.

The Broader Investment Principle at Work

This regulatory change underscores a fundamental truth about investing - Costs Matter. A Lot.

Investment costs work against you in two ways. First, they reduce your immediate returns. A 2.5% fee means 2.5% less money working for you this year. Second, they reduce the amount available to compound over time. That lost 2.5% doesn't just disappear. It represents decades of potential growth you'll never see.

Consider a $100,000 portfolio growing at 6% annually over 30 years:

- At 2.5% annual costs: Your portfolio grows to approximately $271,188

- At 1% annual costs: Your portfolio grows to approximately $411,614

.png?width=880&height=410&name=Portfolio%20fee%20costs%20(1).png)

That's a difference of $140,426 (more than your original investment) lost to fees. This is why you should consider measuring and minimizing investment costs.

What Happens Next

- Industry education campaigns: Firms will try to prepare clients for the new disclosures, framing them positively while managing expectations.

- Fee compression: Some firms may proactively reduce fees to avoid sticker shock when clients see the total dollar amounts.

- Product shifts: Expect increased promotion of lower-cost ETFs and index funds as firms try to reduce their clients' visible fee burden.

- Advisor attrition: Some advisors, particularly those who relied on high-cost products and opaque fee structures, may leave the industry.

For investors, this creates opportunity. Use this moment of industry disruption to ensure you're working with a firm aligned with your long-term interests.