Registered Accounts for Beginners: TFSA, RRSP, RRIF, and FHSA.

If you're looking to build wealth in Canada, understanding registered accounts is essential. These tax-advantaged accounts can help you save for retirement, your first home, or any financial goal, while keeping more money in your pocket.

We get it, there are multiple account types available, each with different rules and benefits… so how do you know which one is right for you?

Let us break down Canada's four main registered accounts so you can make informed decisions that align with your financial goals.

Understanding Registered Accounts

While you could invest in a regular taxable account, registered accounts offer significant tax advantages. By minimizing taxes, more of your money stays invested and working for you.

The Canadian government created these accounts to encourage saving for retirement, building emergency funds, and helping first-time homebuyers enter the housing market.

Tax-Free Savings Account (TFSA)

Despite its name, the TFSA isn't just a savings account introduced in 2009, it's a versatile investment account that can hold stocks, bonds, mutual funds, and more.

.png?width=491&height=170&name=TFSA%20(1).png)

If you've never contributed to a TFSA and were eligible since 2009, meaning you were 18 or older, have a valid Social Insurance Number (SIN), and are a Canadian resident, you have substantial room to catch up. This unused contribution room carries forward indefinitely, allowing you to contribute more when your financial situation improves.

TFSA offers Flexible Withdrawals

- Flexible withdrawals: You can withdraw funds at any time, for any purpose.

- Tax-free withdrawals: All withdrawals are tax-free and do not count as taxable income.

- Contribution room is restored: Any amount withdrawn is added back to your TFSA contribution room on January 1 of the following year.

- No withdrawal age restrictions: Unlike registered retirement plans, there is no minimum age for withdrawals.

- No penalties or restrictions on use: Funds can be used freely without triggering taxes or penalties.

Why this matters:

In a regular taxable account, investment gains may be subject to capital gains tax. Over time, this can amount to thousands of dollars in lost after-tax returns, a cost the TFSA helps investors completely avoid.

Registered Retirement Savings Plan (RRSP)

The RRSP has been Canada's primary retirement savings vehicle for decades. Its tax-deferred growth and upfront deductions make it particularly attractive for higher-income earners.

.png?width=814&height=88&name=RRSP%20(1).png)

*Unused contribution room carries forward indefinitely

RRSP contributions are tax-deductible, such that these contributions reduce your taxable income, often resulting in a tax refund based on your marginal tax rate.

Therefore, by reducing your tax bill today, you have more capital to invest, which can then compound over decades.

Important RRSP Rules

- You must convert your RRSP to a RRIF by December 31 of the year you turn 71

- Early withdrawals trigger immediate withholding tax (10-30% depending on amount)

- Under Home Buyer’s Plan (HBP) you can withdraw up to $60,000 for a home purchase which must be repaid over 15 years to avoid being treated as taxable income.

Registered Retirement Income Fund (RRIF)

RRIF isn't something you contribute to, it's what your RRSP becomes when you reach age 71.

By December 31 of the year you turn 71, you must convert your RRSP to a RRIF or purchase an annuity, or withdraw the funds as taxable income.

Once converted:

- Your investments continue growing tax-deferred

Growth inside a RRIF remains tax-deferred; tax is only paid when withdrawals are made. - You must withdraw a minimum amount annually based on your age

The CRA sets an annual minimum withdrawal percentage, based on your age (or your spouse’s age, if elected). - Withdrawals are taxed as regular income

RRIF withdrawals are fully taxable at your marginal tax rate (no capital gains treatment). - There’s no maximum withdrawal limit

You can withdraw more than the minimum at any time; only the minimum is mandatory.

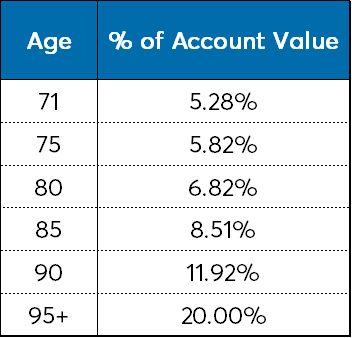

Minimum Withdrawal Requirements

RRIF minimum withdrawals start low and increase with age.

These minimums ensure the government eventually collects tax on the money that grew tax-deferred in your RRSP.

It is important to keep in mind that RRIF withdrawals count as taxable income, which can affect:

- Old Age Security (OAS): Withdrawals that push your income above $90,997 (2025 threshold) trigger OAS claw-back

- Guaranteed Income Supplement (GIS): Higher income reduces or eliminates GIS eligibility

- Age Credit and other benefits: Income-tested credits may be reduced

4 RRIF Strategies We Recommend

- Consider delaying conversion: You can convert before age 71 if you need retirement income earlier

- Base minimums on spouse's age: Use your younger spouse's age to calculate lower minimum withdrawals

- Plan around OAS claw-back: Time larger withdrawals for years before OAS begins

- Coordinate with CPP and other income: Manage total retirement income to stay in optimal tax brackets

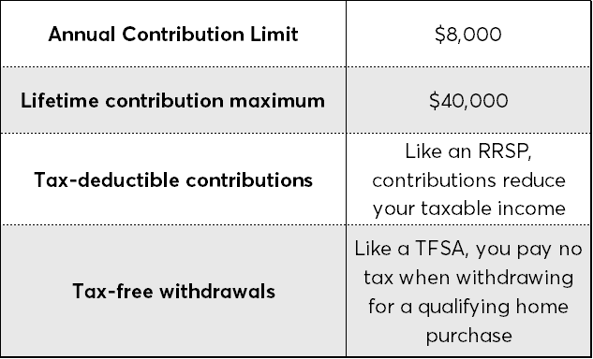

First Home Savings Account (FHSA)

Introduced in 2023, the First Home Savings Account represents the government's latest effort to help Canadians achieve homeownership.

The FHSA combines the best features of both the RRSP and TFSA,

Although, this comes with important time constraints:

- You must use the funds within 15 years of opening the account or by the end of the year you turn 71 (whichever comes first)

- The account must be closed by the end of the year following your first qualifying home purchase

- If unused, funds can be transferred tax-free to your RRSP or RRIF, or withdrawn as taxable income

Combining FHSA with the Home Buyers' Plan

You can use the FHSA alongside the Home Buyers' Plan (HBP), which allows you to withdraw up to $60,000 from your RRSP for a home purchase.

This means you, as a first time home buyer, could potentially access up to $100,000 in registered savings for their down payment.

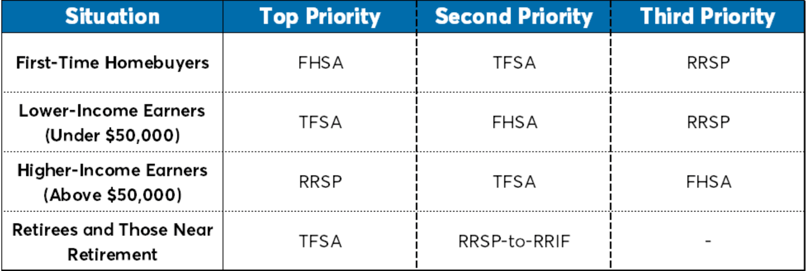

Choosing the Right Account for Your Situation

Common Mistakes to Avoid

Even experienced investors make costly mistakes with registered accounts. Here's what to watch out for:

- Over-Contributing: Exceeding your contribution limits in TFSA, RRSP, or FHSA can trigger penalties (e.g., 1% per month on excess amounts)

- Not Understanding the Withdrawal Rules

- TFSA: Can withdraw anytime, but contribution room doesn't return until next year

- RRSP: Early withdrawals trigger withholding tax (10-30%) and are taxed as income

- FHSA: Non-qualifying withdrawals are taxable and can't be returned

- RRIF: Must meet minimum withdrawals; excess withdrawals are taxable

- Re-Contributing to TFSA in the Same Year: This can easily cause an over-contribution penalty if you haven’t restored room first"

- Prioritizing the Wrong Account Type: Choosing the wrong registered account for your goals can reduce long-term tax efficiency

- Not Maximizing Employer Matching: Failing to capture full employer RRSP match means missing out on potentially large, cost-free contributions

- Poor Asset Location Strategy: where you hold investments matters. Learn how to set your asset allocation.

Putting It All Together

By understanding how each account works and matching them to your specific situation, you can reduce lifetime tax burden, build wealth efficiently, maintain flexibility, and create a sustainable income stream once you hit retirement