The advice "buy low, sell high" is often seen as a straightforward investment strategy, but it...

Mastering Strategic Asset Allocation to Build Long-Term Wealth

Investing is a journey, not a sprint. At SciVest, we believe that building wealth is best accomplished through disciplined, long-term strategies. One of the most effective methods to achieve this is through Strategic Asset Allocation (SAA). This approach aligns with many of our Core Investment Principles, including Long-Term Compounding, Diversification, Risk Management, and Avoiding Market Timing.

This blog post explores SAA, offering practical insights and examples tailored to investors in Canada.

What is Strategic Asset Allocation (SAA)?

Strategic Asset Allocation is often compared to setting a roadmap for your financial future. Just as a well-planned journey accounts for road conditions, weather, and alternate routes, SAA helps investors navigate financial markets with a clear, structured approach.

Strategic Asset Allocation is a long-term investment strategy where an investor establishes target allocations for various asset classes, equities, fixed income, cash, and alternatives, based on their financial goals, risk tolerance, and time horizon.Key objectives of SAA:

- Balance risk and return

- Manage long-term investment goals

- Create a disciplined framework for portfolio management

SAA avoids reacting to short-term market movements, focusing instead on a structured and disciplined plan, with periodic rebalancing to maintain the intended portfolio mix.

Why does SAA matter?

Studies as far back as the 1980's show that asset allocation is the primary driver of a portfolio’s long-term performance. The groundbreaking study by Brinson, Hood, and Beebower (1986), titled 'Determinants of Portfolio Performance,' published in the Financial Analysts Journal, found that over 90% of a portfolio’s returns can be attributed to asset allocation rather than individual security selection or market timing.

By maintaining a strategic approach, SAA reduces the likelihood of emotional, impulsive investment decisions, particularly during market volatility.

Dynamic and Tactical Asset Allocation

While SAA is a long-term strategy, Tactical Asset Allocation (TAA) and Dynamic Asset Allocation (DAA) provide room for flexibility.

Tactical Asset Allocation (TAA):

- Allows temporary shifts from target allocations to capitalize on short-term opportunities.

- For example: Increasing equity exposure when valuations are low.

- Our core principle is to Avoid Market Timing, but tactical adjustments are sometimes warranted.

Dynamic Asset Allocation (DAA):

- Adjusts asset weights based on evolving market conditions

- Useful during significant economic regime shifts (e.g., interest rate cycles)

Diversification: The Bedrock of SAA

Diversification involves spreading investments across different asset classes to reduce risk. It's a cornerstone of long-term wealth management and a key component of what we do.

Why diversify?

- Reduce portfolio volatility

- Enhance risk-adjusted returns

- Protect against poor performance in any single asset class

For Canadian investors, diversification often includes:

- Balancing Canadian equities (TSX Index) with U.S. (S&P 500) and international markets (MSCI EAFE).

- Including fixed income (Government of Canada bonds), GICs, and international bonds.

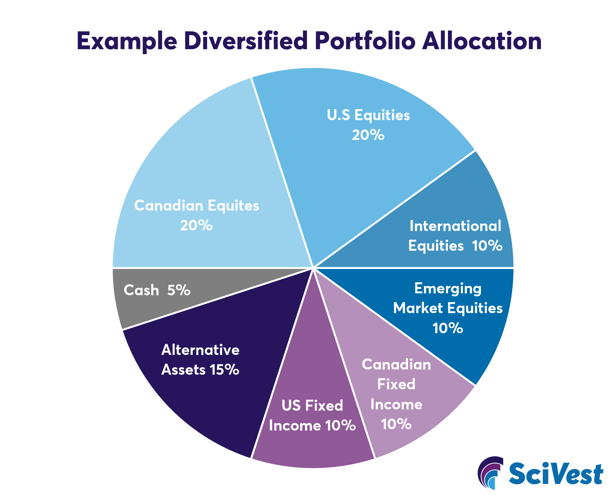

A Classical Example of a Diversified Portfolio Allocation

A globally diversified portfolio may include:

- 60% Equities: 20-25% Canadian, Bal % International (US & EAFE)

- 20% Fixed income

- 15% Alternatives

- 5% Cash

As a pie chart that would look like the following:

Incorporating Alternative Assets and ESG Factors

Diversification can be expanded by including alternative assets and optionally by integrating Environmental, Social, and Governance (ESG) factors.

- Real Estate Investment Trusts (REITs - a good fixed income stream)

- Commodities - these stocks do not in tandem with the TSX (e.g., Infrastructure equities - pipelines, energy, renewable energy, gold, which has increased in Canadian portfolios in 2024 by 38% according to Investopedia)

- Private equity

- Increasingly important for long-term risk management and returns

- Norway’s Government Pension Fund Global uses ESG factors across 96% of its portfolio (Reuters)

Rebalancing: Staying on Course

Over time all portfolios drift due to market movements. This is a natural as some parts of the portfolio perform better than others. Regular rebalancing brings the portfolio back to its intended allocation, maintaining the desired risk profile.

Rebalancing Strategies:

- Calendar-based (e.g., annual)

- Threshold-based (e.g., rebalancing when allocations drift more than 5%)

Why Rebalance?

- Control risk

- Lock in gains

- Maintain discipline and consistency

Example: 60% Equity Allocation

Below is an example of 60% equity allocation in a portfolio and tracking it as a % of the total portfolio. (left axis)

This graph shows how a portfolio’s allocation (e.g., to equities) can drift over time due to market movements, and how rebalancing help bring it back on track. The time horizon taken is the start of 2021 all the way to February 2025:

- Light blue Line: Shows what happens if you don’t rebalance, your allocation can slowly shift away from your target (60% in this example), increasing risk.

- Dark Blue Line: Resets the allocation to 60% once a year, typically at the start of a new calendar year.

- Red Line: Represents the asset allocation percentage set by the investor. The percentage set for equities is 60% and the rest is allocated to fixed income

Conclusion

Strategic Asset Allocation provides a structured, disciplined approach to investing that supports long-term wealth building. By embracing diversification, regular rebalancing, and a long-term mindset, investors can navigate complex markets with confidence.

We believe in the power of a well-structured portfolio, informed by strategic asset allocation, to deliver sustainable, long-term results.