Asset allocation represents how an investment portfolio is structured using stocks, bonds, and...

Is Home Country Bias Costing You Money?

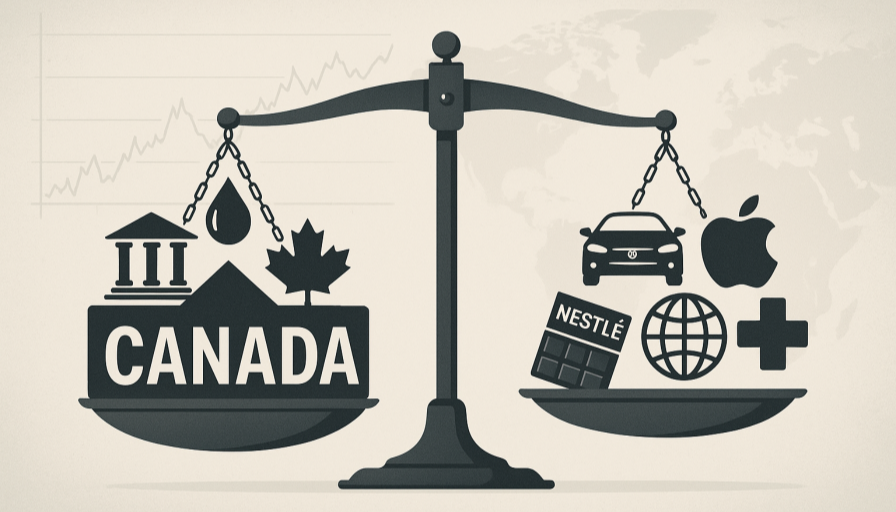

Home country bias, the tendency to favor investments from your home country, is a common habit among investors worldwide. Could this bias be costing you money and adding unnecessary risk to your portfolio? For many Canadian investors (and even those in other G7 countries), the answer is yes. This blog post will explain what home country bias is, why it’s risky (especially in Canada’s market), and how diversifying internationally can improve your investment outcomes.

What Is Home Country Bias?

Home country bias is an investor’s preference to invest primarily in domestic assets (usually stocks) while underweighting foreign investments. In other words, it’s when you put most of your money in companies from your own country, ignoring the fact that there’s a whole world of investment opportunities out there. Home bias often leads investors to hold a majority of their portfolio in domestic equities, despite the benefits of global diversification.

This phenomenon is widespread across the globe, it’s not just Canadians. Americans, for example, invest roughly 85% of their stock portfolios in U.S. companies, even though the U.S. market makes up only about 60% of the global stock market.

In countries like Japan, the UK, Germany, and others, investors also exhibit a strong preference for local stocks.

In essence, many people feel safer investing in what they know (their home market) and shy away from foreign investments.

Why does home bias happen?

Historically, there were practical barriers to global investing, things like higher transaction costs, currency conversions, limited access to foreign markets, and less information about overseas companies.

These hurdles made it more difficult and costly to invest abroad, so sticking to domestic stocks was the default. There’s also a psychological comfort factor: we tend to trust what is familiar. This is sometimes called familiarity bias, we feel we understand local companies, brands, and economic conditions better than foreign ones, so we “stick to what we know”. Other behavioral factors include overconfidence and a perception that foreign markets are riskier or more opaque. In Canada, there’s even a bit of national pride at play, as one Vanguard Canada expert noted, Canadians have a “long-standing belief and pride” in investing close to home (wealthprofessional.ca).

Ironically, global investing has never been easier or cheaper. Online platforms and low-cost ETFs offer simple access to international markets, with a wealth of information readily available. Finally, international index funds and ETFs make global investing remarkably accessible.

Despite this, home bias persists, driven largely by habit and emotion rather than logical planning.

Home Bias in Canada: How Bad Is It?

Canadian investors have historically shown one of the highest home biases in the world. The good news is this bias is slowly declining, but it’s still significant. Recent research by Vanguard Canada (2024) found that Canadian investors now allocate about 50% of their equity portfolio to domestic (Canadian) stocks. A decade ago, this figure was even higher, around 67% in 2012, so there’s been improvement.

This is striking when you consider that Canada makes up just 2.5–3.0% of the global stock market. That means Canadians are allocating 15–20 times more to local equities than Canada’s global share. Vanguard put it plainly: a 50% home bias equals “18 times more” exposure than justified by Canada’s weight in global indexes.

Source: International Monetary Fund’s Coordinated Portfolio Investment Survey (2023) & Canada Market cap data as of April 2024

Picture the global market as a full pie, with Canada representing just a small slice. Yet many investors concentrate a large portion of their portfolios on that one piece, missing out on the other 97% of opportunities around the world.

It’s not just retail investors. As of late 2019, 54% of Canadian-domiciled ETF assets were in Canadian stocks, with just 24% in U.S. equities and ~20% globally.

This domestic focus has been prevalent, though it’s gradually shifting as advisors and investors recognize the need for global diversification.

While this domestic focus is shifting, it still lingers. Other G7 countries show home bias too, but with key differences. U.S. investors, for example, hold about 85% in domestic stocks, even though the U.S. makes up ~60% of global markets. But because the U.S. market is large and sector-diverse, its home bias carries less concentration risk than Canada’s smaller, more narrowly focused market (investopedia.com).

The Risk of Overconcentration in Canada’s Market

One of the biggest pitfalls of home country bias is "overconcentration": you end up with a portfolio that’s not well diversified because it’s heavily tilted to the fortunes of one country’s economy and a few dominant sectors. This risk is especially pronounced for Canada.

The Canadian stock market (represented by indexes like the S&P/TSX Composite) is highly concentrated in a few sectors. As of 2025, about 32% of the TSX index is in financial services (banks, insurance, etc.).

All together, roughly 62%+ of the Canadian equity market is tied up in just three sectors: financials, energy, and materials.

This concentration means if those sectors hit a slump, Canadian portfolios get hit hard.

Meanwhile, other sectors are underrepresented in Canada. For example, technology is only about 8% of the TSX by weight, and health care is a very small portion (Canada has few large pharma/biotech firms). Compare this to a global index like the MSCI World or MSCI All-Country World Index (ACWI): tech companies make up roughly 20–25% of global equities (msci.com), and other sectors like consumer goods, industrials, and healthcare each hold substantial weights. The U.S. market is home to global growth drivers like Apple, Microsoft, Amazon, and Google, none of which are captured in Canadian indices. European and Asian markets bring exposure to auto giants, luxury brands, telecoms, and hardware firms—opportunities Canadian-only portfolios miss out on.

The danger for Canadian investors with a strong home bias is that you end up with a less diversified portfolio that can be very volatile and dependent on commodity cycles and domestic economic conditions. For instance, if oil prices crash or the Canadian housing market faces trouble (impacting banks), a Canadian-heavy portfolio could drop significantly while more globally balanced portfolios might better withstand the shock. A report from Morningstar Canada noted that Canada’s narrow sector representation and small share of global market cap means Canadians especially benefit from “spreading one’s bets” across borders (indexes.morningstar.com).

Otherwise, you may be “putting all your eggs in one (small) basket”. See our What is Diversification article for more on that.

Missing Out on Growth Opportunities

Home bias doesn’t just increase risk, it can also mean missing out on higher returns elsewhere, i.e. an opportunity cost.

Simply put, the 2010s saw U.S. and international stocks (especially tech-driven markets) dramatically outperform Canadian stocks. The S&P/TSX Composite’s returns were respectable, but they were eclipsed by the S&P 500’s returns. So a Canadian who stayed 100% at home earned a lot less than one who held some Apple, Google, or international growth stocks in their portfolio.

Even looking forward, no single country’s market is guaranteed to lead every year. Leadership rotates: one year U.S. stocks might surge, another year European or Asian markets might outperform, and sometimes Canadian stocks will be on top. If you’re globally diversified, you can capture the winners wherever they are. If you’re not, you could be stuck with a laggard market. In the words of an FTSE Russell strategist commenting on Canadian home bias: Canadian investors focusing only on Canada are “missing out on diversification” and the growth available in markets like the U.S. or even Europe.

Benefits of International Diversification

The cure for home country bias is international diversification, spreading your investments across countries and regions, not just at home. Diversification is a core principle of sound investing for many reasons:

- Reduces Single-Country Risk: Every country faces unique economic cycles, industry booms/busts, and political risks. By investing globally, you ensure that no one country (or its government or central bank policy) can make or break your entire portfolio.

- Broader Sector Exposure: As discussed, Canada’s market is heavy in a few sectors and light in others. International investing gives you access to sectors and industries that aren’t big in Canada, like global technology, healthcare innovation, industrial manufacturing, consumer brands, etc. This fills the gaps that a Canada-only portfolio would have.

- Potential for Smoother Returns: Diversification across uncorrelated markets can actually reduce portfolio volatility. When one market zigs, another may zag, smoothing out overall portfolio performance. Canada’s market, for example, often tracks commodity price cycles. Other regions may react differently, some even benefit when oil prices fall, like oil-importing countries as Vanguard Canada noted, lack of diversification can lead to greater volatility and inefficiency.

Conversely, adding global stocks can improve your risk-adjusted returns, earning more for each unit of risk by avoiding overexposure to a single market. - Enhanced Long-Term Returns: While not a guarantee, a wider opportunity set increases the chances of owning the best performers. Over long periods, having exposure to international markets can boost returns because you’re not missing the growth stories that occur outside Canada. A simple example: in the 2000s, emerging markets like China, India, and Brazil had enormous growth and stock market booms; Canadian-only investors saw none of that. In the 2010s, the U.S. tech boom led global returns; again, without U.S. stocks, you missed it. By diversifying, you are positioned to benefit wherever growth happens.

- Currency Diversification: Holding foreign investments also means exposure to foreign currencies (unless you hedge, which we’ll discuss later). This can sometimes help as well, for example, if the Canadian dollar weakens, the value of your foreign assets in CAD terms will rise, partially offsetting domestic losses. It’s another layer of diversification (though it can add short-term volatility, it often evens out over the long term).

Another thing to realize: global investing doesn’t mean taking on “exotic” or unnecessary risk. We’re talking about investing in other developed markets (like the US, Europe, Japan) and perhaps some allocation to emerging markets, all of which are well-established investment arenas. Many of the world’s largest, most stable companies are outside Canada. By owning them, you’re not gambling; you’re arguably investing more prudently by not putting all your money in one economy.

The consensus among experts is clear: global diversification is beneficial.

Why Do We Stick to Home Bias? Behavioural Insights

If global investing is so clearly advantageous, why do many intelligent investors still lean heavily at home? The answer often lies in psychology and behavioral biases. Understanding these biases is the first step to overcoming them:

- Familiarity & Comfort: We tend to invest in what (and whom) we know. Canadian investors are very familiar with domestic banks like RBC or TD, telecom companies like Bell or Rogers, or energy companies like Enbridge. We see their brands daily, we might use their services, and we feel we “understand” them. Foreign companies, by contrast, might feel distant or confusing. This familiarity bias makes us feel that local investments are safer, even if objectively a portfolio of only Canadian stocks is riskier due to lack of diversification.

- Home Pride & Patriotism: Many Canadians have a sense of pride in supporting Canadian businesses. There’s nothing wrong with that, it’s natural to have confidence in your home country. In moderation, investing at home is sensible. The problem is when it’s taken to an extreme. As one expert said, “investing close to home is a sound strategy if that exposure is moderate” . Unfortunately, home bias often leads to overexposure.

It’s okay to love Canada, just don’t let that stop you from loving international opportunities too! - Perceived Knowledge/Overconfidence: Investors might believe they have an informational edge with domestic stocks. For instance, you might think, “I hear about the Canadian economy and companies on the news every day, so I can predict it better.” Or, “I work in the oil industry in Alberta, so I know when to buy oil stocks.” This can lead to overconfidence bias, overestimating our ability to evaluate or time the local market, and underestimating the value of just owning a broad global mix.

- Fear of the Unknown (Uncertainty Avoidance): The flip side of familiarity is a subtle fear or distrust of unfamiliar markets. International investing can conjure concerns like: “What if there’s political instability in country X?”, “I don’t know the regulations over there,” or “I don’t understand their currency.” To some, foreign markets seem riskier just because they are not understood as well. While it’s true every market has risks (including Canada’s!), these fears can be exaggerated. Nonetheless, this fear leads people to avoid international exposure, a classic status quo bias (sticking with what you’ve always done).

- Availability Bias (Media and Recent Performance): Investors might recall news of past international crises (say, the Eurozone debt crisis, or volatility in emerging markets) more readily than domestic issues, because foreign crises often get sensational coverage. This can skew perceptions, making foreign markets seem tumultuous. On the other hand, one might remember a time when Canadian stocks did well and extrapolate home success too far in the future.

Source: International Monetary Fund Data as of June 30, 2022

Source: International Monetary Fund Data as of June 30, 2022

It’s worth noting that even professional investors are not immune to home bias. Studies have shown many fund managers and pension managers exhibit a preference for domestic assets, sometimes even a “local bias” (favouring companies headquartered in their province or state).

This is human nature at work.

Being aware of these psychological drivers is important. It helps us realize that home bias is often not a rational, deliberate choice based on data; rather, it’s a default that feels comfortable. Once we recognize this, we can take deliberate steps, grounded in facts and strategy, to counteract the bias.

How We can Counter Home Bias

Let’s look at how four of our Core Investment Principles provide a framework that steers investors away from the dangers of home bias:

- Diversification: Use broad diversification to minimize risk. We believe that portfolio diversification is “by far the most important risk management and mitigation tool” for investors.

- Strategic Asset Allocation: Another core belief is the importance of setting a long-term strategic asset allocation that aligns with your goals and risk tolerance. This means deliberately deciding what percentage of your portfolio to allocate to different asset classes and regions, and sticking to that plan for the long run (with periodic rebalancing). Long-term asset mix decision is the most important factor in determining portfolio return and risk. This approach ensures you benefit from global growth.

- Avoid Excessive Risk (Volatility): Excessive volatility and risk can erode long-term returns. Concentrating investments in one country, like Canada, is a form of excess risk. Home bias leaves your portfolio exposed to country-specific risks. A 90% Canada-focused portfolio, for example, carries more risk than one diversified globally, even if Canada feels stable.

- Long-Term and Unemotional Investing: Because home bias is often emotional and short-sighted. It feels comfortable, but it’s not always rational. Thinking long-term helps investors see that global trends and diversification outweigh the short-term comfort of familiar names. An unemotional investor resists fear, herd mentality, and nationalistic bias, focusing instead on data and proven strategies.

By championing global diversification, deliberate asset allocation, risk control, and rational long-term behaviour, these principles help investors avoid the pitfalls of over concentration in domestic markets. Investors who adopt such principles are far less likely to succumb to home country bias, and more likely to achieve stable, long-term growth.

How to Mitigate Home Country Bias: Actionable Tips

If you suspect home bias might be lurking in your portfolio, don’t worry, you’re certainly not alone, and there are concrete steps you can take to correct it. Here are some practical strategies to overcome home bias and build a more globally diversified investment portfolio:

- Measure and Acknowledge Your Bias: Start by calculating what percentage of your portfolio is Canadian vs. international. Canada makes up only ~3% of global equities, yet many Canadians hold 50–60% or more in domestic stocks. Recognizing this imbalance is the first step.

- Set a Target for Global Allocation: Decide on a reasonable mix, say 30% Canada and 70% international, as a long-term allocation goal. Choose a split that fits your risk profile, and stick to it. Use strategic asset allocation to guide decisions, and refer to model portfolios if unsure.

- Use Global Investment Funds/ETFs: Diversify instantly with international or global ETFs, such as All Country World Index (ACWI) or ex-Canada funds. These low-cost, one-stop solutions offer exposure to thousands of companies worldwide, and many are available in CAD on the TSX.

- Consider Currency-Hedged Options (if Currency Worry is Holding You Back): Worried about exchange rates? Consider currency-hedged ETFs that reduce foreign exchange volatility. Hedging adds minor costs but can ease psychological barriers to investing globally.

- Rebalance Regularly: As markets move, your portfolio can drift from its target allocation. Rebalancing (e.g., annually) keeps your mix in check and avoids a reversion to home bias.

- Broaden Your Investment Horizon (Mentally and Practically): Global diversification isn’t just about geography, it’s about sectors too. Canada is resource-heavy; complement it with international exposure to tech, healthcare, and consumer sectors.

- Think in Terms of Global Sectors, Not Just Countries: Explore international markets and recognize the global brands you already use. Familiarity breeds comfort, and education reduces fear of the unknown.

- Align with Long-Term Goals and Policy: If you’re saving for retirement in an RRSP or building wealth in a TFSA or taxable account, remind yourself that your goal is long-term growth and stability. Write an Investment Policy Statement (IPS) outlining your global strategy. This keeps you focused and unemotional, especially during market swings.

- Stay Unemotional and Objective: Last but not least, keep the right mindset. Remember that investing is not about patriotism or familiarity, it’s about making your money work as efficiently as possible for you.

By implementing these steps, you can gradually mitigate home country bias and build a more resilient, globally balanced portfolio. The changes don’t have to be abrupt, you can shift allocation over time, or allocate new contributions more internationally until your mix is where you want it. The important thing is making that conscious effort. Your future self, enjoying retirement income that isn’t dependent on the fate of one country, will thank you.

Conclusion

Home country bias is a natural tendency, but as we’ve explored, it can carry hidden costs for investors. For Canadian investors in particular, an excessive focus on domestic equities means a less diversified portfolio, greater exposure to local economic swings, higher volatility, and missed opportunities for growth abroad. In an increasingly globalized world, limiting your investments to one small corner of the market just doesn’t stack the odds in your favour.

By recognizing the bias in yourself and using the practical strategies discussed, from global ETFs to regular rebalancing, you can ensure that home bias isn’t silently undermining your financial goals. Remember, it’s not about abandoning Canadian investments entirely; it’s about right-sizing them as one part of a broader, smarter investment plan.

So, is home country bias costing you money?

It very well could be, but it doesn’t have to. With knowledge and action, you can turn a home-heavy portfolio into a well-traveled one. In doing so, you’ll be aligning your investments with the reality of the global economy and setting yourself up for a smoother ride toward your long-term financial destination.

Happy (global) investing!